Getting My File For Bankruptcy To Work

Table of ContentsFascination About Bankruptcy AustraliaOur Personal Insolvency DiariesGetting My Personal Insolvency To WorkSome Known Details About Liquidation Melbourne The Buzz on Bankruptcy Australia

You'll after that have time to collaborate with the court and your financial institutions to determine the next actions. Will I Shed My Home? What occurs to your home depends on whether you file phase 7 or phase 13 insolvency. If you're uncertain which alternative is appropriate for your scenario, see "Insolvency: Chapter 7 vs.Phase 7Chapter 7 insolvency is commonly called liquidation insolvency due to the fact that you will likely need to liquidate several of your possessions to satisfy at the very least a section of what you owe. That stated, state laws determine that some properties, such as your retirement accounts, residence as well as auto, are excluded from liquidation.

Little Known Facts About Liquidation Melbourne.

Phase 13With a chapter 13 bankruptcy, you do not need to stress concerning needing to liquidate any of your home to satisfy your financial debts. Instead, your financial debts will be restructured to ensure that you can pay them off partly or completely over the next 3 to five years. Bear in mind, though, that if you don't abide by the repayment plan, your lenders might be able to pursue your assets to please your financial debts.

That stated, the two types of insolvency aren't dealt with the same method. While phase 13 personal bankruptcy is additionally not suitable from a credit rating point ofview, its arrangement is checked out even more positively due to the fact that you are still paying off at the very least some of your debt, and it will continue to be on your credit score record for up to 7 years. Insolvency Melbourne.

There are some lenders, however, that specifically deal with people that have actually gone via personal bankruptcy or various other hard credit report occasions, so your choices aren't totally gone. The credit history racking up designs favor brand-new info over old information. So with positive credit history practices post-bankruptcy, your credit rating can recuperate in time, even while the bankruptcy is still on your credit record.

The Facts About Bankruptcy Victoria Uncovered

Bankruptcy process are filed in a system called Public Access to Court Electronic Records, or PACER for brief. Essentially, it's even more common for attorneys and also financial institutions to use this system to seek chapter 13 attorneys near me out info regarding your bankruptcy. Yet any person can register and examine if they want to.

It can additionally aid those with poor or restricted debt situations. Various other services such as credit score repair work might cost you up to thousands and just aid eliminate mistakes from your credit history record.

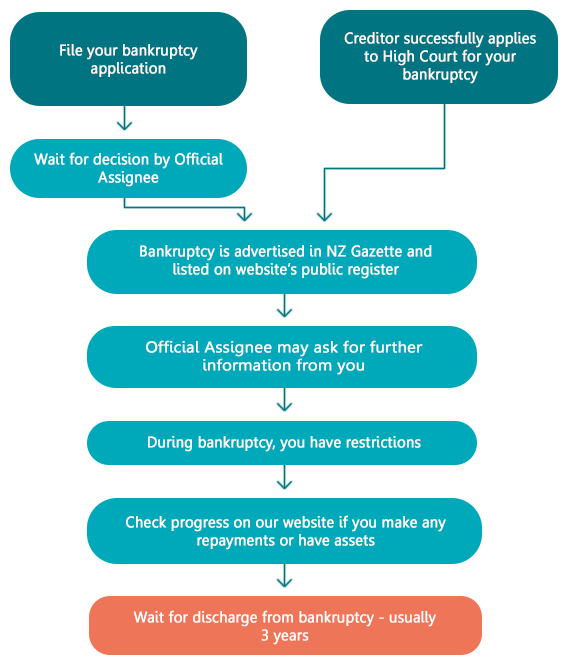

Insolvency is a legal procedure where a person that can't pay their financial debts can obtain relief from an obligation to pay some or all of their financial debts. You ought to obtain assist from a financial coaching service and also lawful advice before obtaining bankruptcy. Coming to be bankrupt has major effects and also there may be various other options available to you.

What Does File For Bankruptcy Mean?

AFSA knows about your obligations while insolvent. There are major repercussions to becoming bankrupt, consisting of: your personal bankruptcy being permanently recorded on the your insolvency being see this page provided on your debt report for 5 years any properties, which are not safeguarded, perhaps being offered not check my blog having the ability to take a trip overseas without the written consent of the bankruptcy trustee not being able to hold the placement of a supervisor of a firm not having the ability to hold specific public placements being limited or protected against from proceeding in some professions or careers your capability to obtain money or get points on credit history being affected your capacity to get rental lodging your capability to obtain some insurance coverage contracts your capability to access some solutions such as energies as well as telecommunication services.

You're allowed to keep some possessions when you come to be bankrupt (Insolvency Melbourne).

It is extremely crucial to obtain lawful suggestions prior to submitting for insolvency if you have a residence. Debts you have to pay regardless of bankruptcy You will still have to pay some debts even though you have come to be insolvent.

See This Report on Bankruptcy Australia

These consist of: court imposed fines and fines upkeep financial obligations (consisting of child assistance debts) trainee support or supplement lendings (HELP College Loan Program, HECS College Contribution Plan, SFSS Student Financial Supplement Scheme) financial debts you sustain after you come to be insolvent unliquidated financial debts (eg vehicle crashes) where the amount payable for the damage hasn't been repaired prior to the date of bankruptcythere are some exceptions debts incurred by fraud debts you're reliant pay due to misbehavior (eg compensation for injury) where the total up to be paid has not yet been dealt with (unliquidated damages)there are some exemptions to this.

It doesn't matter if you're insolvent at the begin or end up being insolvent during the situation. You must tell the court, and everybody entailed in your situation if you're insolvent or in an individual bankruptcy arrangement. You have to likewise tell your insolvency trustee if you're involved in any type of building or spousal upkeep instances.

Telecom Market Ombudsman (TIO) provides complimentary choice disagreement resolution system for unresolved problems regarding telephone or web services.